Crowdfunding refers to the practice of raising varying amounts of money, or capital, from a large number of people to fund a new project, business idea or cause. This is typically done via online platforms (such as Kickstarter, Crowdcube or Seedr). The approach of crowdfunding is often used by businesses to achieve funding, or financing arrangements that are typically used by startups, charities or creative businesses looking for more.

Reward Based

This typically comprises backers contributing financial money in exchange for a reward, or product that is almost always related to the project. These rewards are usually at a discounted rate than what the product will cost when it comes to life and can scale from a small investment (with a small reward) to a large investment. Ultimately this allows a community to be build, with investment coming in all shapes and sizes.

This is widely used for creative projects, start ups or product innovation by a new brand or company. Businesses would use platforms such as Kickstarter and Indiegogo to operate this model.

Equity Crowdfunding

The main piece is in the name. It is an exchange of financial investment for capital shares in the specific company. This is usually used by businesses who require finances to complete a certain product, or service to gain the investment required to complete. Rather than following a traditional method of fundraising. The investment can be unlimited, which allows companies to obtain as much funding as the market dictates – without the need to diversify their share holding to a level that they wouldn’t be comfortable with.

This is widely used by product based companies, who require funds to complete. Businesses would use platforms such as Crowdcube and Seedrs to facilitate this model.

Donation Based

Backers would donate financial investment to a specific product or cause, without expecting anything in return for this. It is unlikely businesses would opt for this approach, but typically charitable causes or localised community projects use this approach.

Platforms such as JustGiving and GoFundMe are popular places to raise money in this way.

Peer to Peer Lending

One of the least well known crowdfunding opportunities, but peer to peer lending is starting to grow. Mainly backers lend money to individuals or businesses in exchange for interest payments. Very financially focused, this allows companies to secure loans without going through the traditional bank method.

Platforms such as Funding Circle and Zopa are popular places to make this investment.

Sole purpose of raising money, think again… More recently brands have been harnessing this new wave of fundraising exploits to bring much more, especially from a brand awareness and customer engagement perspective.

Often brands use crowdfunding in the following ways, externally of financial investment;

- Building a loyal community following

- Validating & Testing an idea

- Amplying Brand Awareness

- Social Proofing

This approach can really transform a brand or companies external view especially if the crowdfunding starts extremely well. It can typically bring in audiences, or potential customers, from outside their usual customer groups – which if brands are diversifying can be extremely valuable.

Ultimately, we are firm believers at Mobility Digital that Crowdfunding is an extremely important external funding source with the additional benefits of that have been highlighted above. Understanding the best platform to showcase your brand or idea is very important and can be the difference between success and failure.

Business Examples – All with a little twist to them..

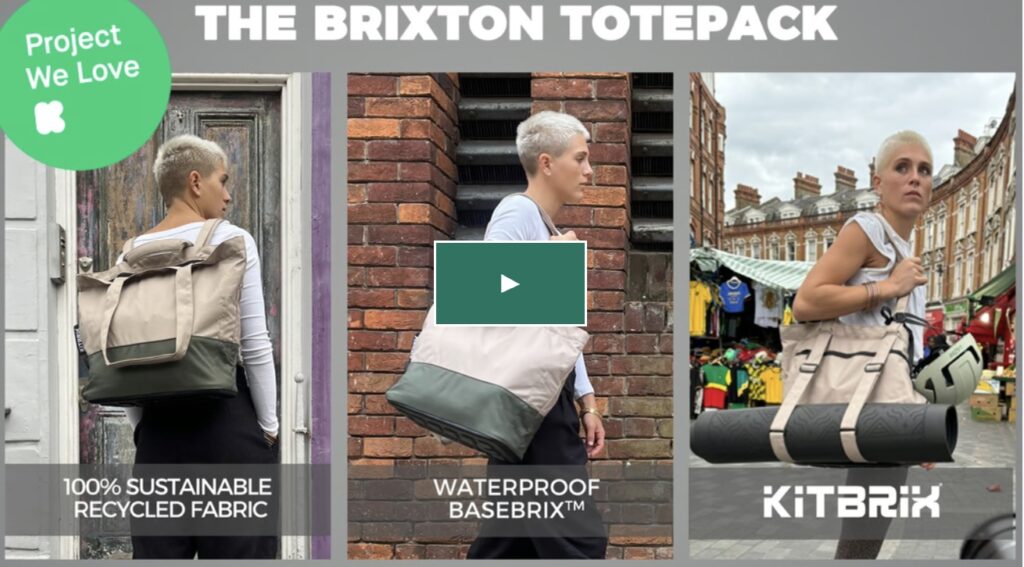

Kitbrix – As a brand being heavily involved in cycling and triathlon it is a brand that is widely known in that space. I had the pleasure of meeting Lara a few years back and managed to find out much more about the brand and what it stands for. The challenge for KitBrix is their product quality is amazing and its a product for life in a very small industry, so the repurchase from customers is very low.

Recently they have diversified, significantly, but kept the same quality of product offering. The potential audience for their new Tote bag is a much larger opportunity. At time of writing, the brand has outperformed its immediate funding target by greater than 600% and has appealed to a much wider audience.

I firmly believe this approach could propel the brand into new market segments alongside obtaining capital funding to drive more product innovation. Which is what they do extremely well.

RollBoys – Recently I was introduced to this brand through a close friend who is supporting the business owner. The brand story really struck me as something I had seen before, in the industry, but never seen a brand completely devote themselves to cinnamon rolls (& who doesn’t love a cinnamon roll).

The founder, George, is very early in his journey but has a great brand logo – which really allows for consumers to understand the ethos of the brand.

Brewdog – Now this might be a left field one, given the size of Brewdog which is currently valued at around 2Billion Dollars & employees over 2,600 people worldwide. That said Brewdog was developed as a c

Their ‘equity for punks’ programme attracted over 1,300 investors in the first round, which raised just shy of £600,000 for the company. Pretty impressive for the first round however the last investment round raised a staggering £26.2million from nearly 100,000 investors.

Brewdog used a mixture of types of crowdfunding, combining rewards based and equity into a single, unified approach which allows the company to grow its awareness alongside capital available quickly. Arguably the business could have gone to the bank, or a private investor to gain this capital – but by using a marketing activation campaign meant they grew brand awareness at the same stage. Chapeau.